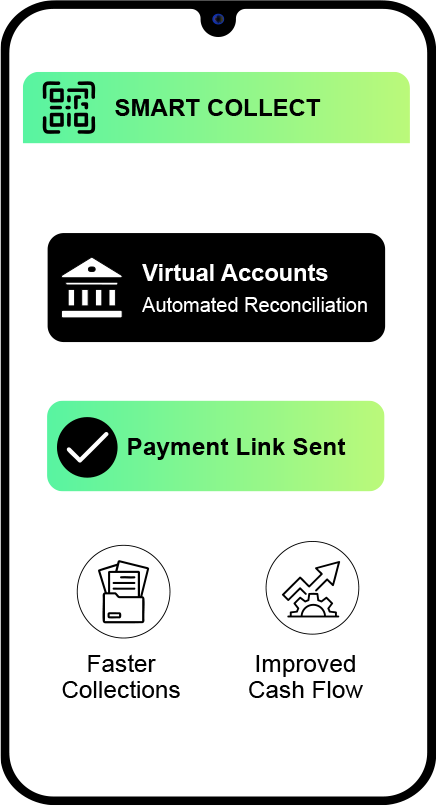

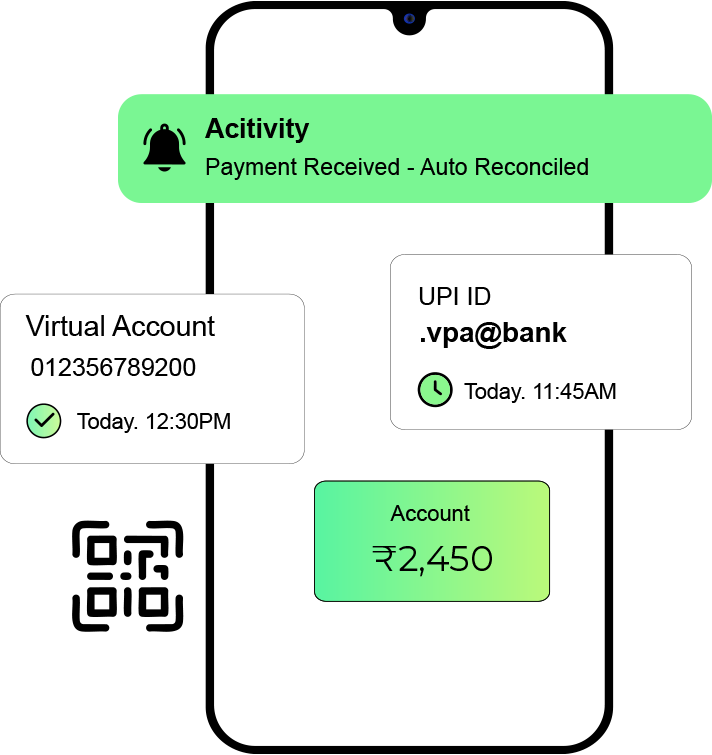

We generate unique virtual accounts and UPI IDs for every customer or transaction through our Smart Collect system. Our process eliminates reconciliation hassles, automatically mapping payments in real time. With faster settlements and reduced manual tracking, we help businesses scale operations without chasing outstanding payments, thus making smooth processes.

Our Smart Collect solution automates every step of the collection process, ensuring each payment is tracked, verified, and instantly recorded. We deliver accuracy, speed, and control, lowering operational costs while improving financial management and enhancing customer payment experiences across all transaction channels, ensuring our client maintains a clear view.

Automated Reconciliation

Faster Settlements